AI For Trading:Factor Models (47)

Factor Model(因子模型)

A factor model is a statistical model used to describe variability among observed correlated variables, in terms of potentially smaller number of unobserved variables called factors.

因子模型是用于描述观察到的相关变量之间的可变性的统计模型,其中可能较少数量的未被观察到的变量被称为因子。

This method is actually used in several disciplines including biology, psychology, and business, as well as finance.

- Latent variables

- Model asset returns

- Common variability

Terminology(术语)

The terminology used to describe factor models varies widely. Here are some common phrases used to refer to the components of the model.

用于描述因子模型的术语差异很大。以下是一些用于指代模型组件的常用短语。

Factor returns (the \(f_kS\)) may be:

- macro-economic variables (宏观经济变量)

- returns on pre-specified portfolios,(返回预先指定的投资组合)

- returns on zero-investment strategies (long and short positions of equal value) giving maximum exposure to fundamental or macro-economic factors,

- 回报零投资策略(同等价值的多头和空头头寸),最大限度地暴露基本面或宏观经济因素,

- returns on benchmark portfolios representing asset classes,(表示资产类别的基准投资组合的回报)

- or something else.

The \(b_{ij}\) coefficients may be called:

- factor exposures,

- factor sensitivities,

- factor loadings,

- factor betas,

- asset exposures

- style

- or something else.

The \(e_i\) term may be called:

- idiosyncratic return,(特质回归)

- security-specific return,(安全特定的回报)

- non-factor return(非要素回报)

- residual return,(剩余回报)

- selection return

- or something else.

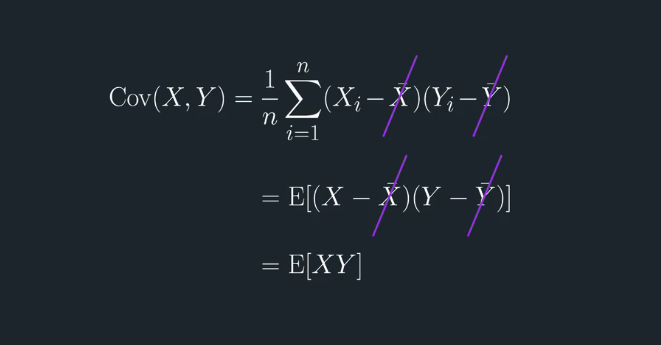

Covariance Matrix Using a Factor Model

Factor Models in Quant Fiance

How are they used in practice? It might not be what you expect. Most practitioners dont use factor models to explicitly model asset returns. Factor modeling has a long history in academic research, and some of these methods were used in the past to explicitly model returns time series. But when devising and testing trading strategies, the models are typically used slightly differently.

Risk Factors v. Alpha Factors

In general, risk factors are significant contributors to the variance of asset returns, and less predictive of the mean of returns. Risk factors are identified to control risk. One way to do control an asset's exposure to a risk factor is to hold an equal amount long as short. For instance, a dollar neutral portfolio with equal amounts long and short is controlling for risks that the overall market may move up or down.

一般而言,风险因素是资产收益差异的重要贡献因素,并且对回报均值的预测性较低。确定风险因素以控制风险。控制资产暴露于风险因素的一种方法是持有等量的多头。例如,持有多头和空头等额的美元中性投资组合可以控制整体市场可能上涨或下跌的风险。

In general, risk factors that are significant in describing the mean of asset returns can be candidates for alpha factors. Alpha factors are used to give some indication of whether each stock in the portfolio may have positive expected returns or negative expected returns. For example, a former alpha factor was the market capitalization of a stock. Small cap stocks tend to have higher future returns compared to large cap stocks.

一般而言,描述资产收益均值的重要风险因素可能是α因子的候选因素。Alpha因子用于表示投资组合中的每只股票是否具有正预期收益或负预期收益。例如,前α因子是股票的市值。与大盘股相比,小盘股的未来回报往往更高。

Characteristics of risk factors and alpha factors

Usually, we'd choose 20 to 60 risk factors that describe overall stock variance as much as possible. So risk factors as a whole account for more of the overall movement of stocks.

通常,我们会选择20到60个风险因素来尽可能地描述总体股票差异。因此,风险因素作为一个整体占据了股票整体走势的更多因素。

On the other hand, alpha factors contribute to smaller movements of stocks, which is okay, because we seek to identify these alpha factors because they give some indication of the direction of expected returns, even if they're small compared to risk factors.

另一方面,α因素有助于减少股票的流动,这是可以的,因为我们寻求识别这些α因子,因为它们给出了预期收益方向的一些指示,即使它们与风险因素相比也很小。

An important reason why it's important to identify risk factors and then neutralize a portfolio's exposure to risk factors is that if we didn't, the asset movements due to risk factors would overwhelm the movements that are due to the alpha factors.

确定风险因素然后中和投资组合风险因素风险的重要原因是,如果我们不这样做,由风险因素引起的资产流动将压倒由于α因素引起的变动。

Risk factors are well-known

Risk factors are well-known by the investment community, so investors will track those factors when optimizing their portfolios. This also means that it's unlikely that any one investor can gain a competitive advantage (higher than normal returns) using risk factors.

风险因素是投资界所熟知的,因此投资者在优化投资组合时会追踪这些因素。这也意味着任何一个投资者都不可能使用风险因素获得竞争优势(高于正常回报)。

Alpha factors becoming risk factors

An alpha factor that is generated by internal research in a fund can help that fund seek a competitive advantage in the market. If the proprietary factor isn't yet discovered by the rest of the investment community, most others won't act on that signal when making investment and trading decisions.

Alpha factors usually lose their effectiveness over time. One possible reason is that as other funds also discover the factor, and make investment decisions based on its signal, then the above-average gains or arbitrage opportunities get diffused as they're shared by a growing number of market participants. Eventually, if a factor becomes very well known and most investors are acting on its signal, then the factor can be considered more of a risk factor.

Among quants, you may hear the joke that "your alpha factor is my risk factor," since it's up to each fund to decide whether to use a factor to control risk or to drive returns.

在量化交易中,您可能会听到“您的α因子是我的风险因素”的笑话,因为每个基金都要决定是使用因子来控制风险还是提高回报。

为者常成,行者常至

自由转载-非商用-非衍生-保持署名(创意共享3.0许可证)