AI 量化交易-基础成对交易算法实现 (二)

【实战】基础成对交易算法实现

数据获得

想要做量化,首先你得有数据。股市的交易数据的来源可以有很多地方,比如直接对接交易所,比如从万徳,彭博社,路透社等数据第三方。当然,以上大部分都是收费的,企业用户用起来无压力,个人用户就有点吃力了。所以我这里还推荐一些免费的交易数据网站,大家可以玩一玩:

http://www.financialcontent.com/

https://www.quandl.com/ (教育目的免费)

他们都提供很直观便捷的API,大家注册一下就可以了,然后就可以下载或者导入自己需要的数据资源。

选取目标股票

假设,按照我们前面讲的理论,我们找一些相同行业内的企业,来首先保证他们之间有足够强的内在经济联系

我来举几个大家熟悉的美股饮料公司的股票:

import pandas as pd从各种可行的数据源下载或者导入这些股票的历史交易记录,并读入

data_PEP = pd.read_csv('./data/daily_PEP.csv', index_col=[0],usecols=['timestamp','close'])

data_PEP.columns = ["PEP"]

data_KO = pd.read_csv('./data/daily_KO.csv', index_col=[0],usecols=['timestamp','close'])

data_KO.columns = ["KO"]

data_KDP = pd.read_csv('./data/daily_KDP.csv', index_col=[0],usecols=['timestamp','close'])

data_KDP.columns = ["KDP"]

data_MNST = pd.read_csv('./data/daily_MNST.csv', index_col=[0],usecols=['timestamp','close'])

data_MNST.columns = ["MNST"]我们暂时不需要所有的信息,只需要每天的closing price,所以,我们精简一下数据

print(data_PEP) PEP

timestamp

2018-12-13 118.35

2018-12-12 117.00

2018-12-11 117.29

2018-12-10 116.19

2018-12-07 115.82

2018-12-06 116.84

2018-12-04 117.80

2018-12-03 118.98

2018-11-30 121.94

2018-11-29 118.27

2018-11-28 118.50

2018-11-27 116.44

2018-11-26 115.86

2018-11-23 115.41

2018-11-21 115.28

2018-11-20 116.00

... ...

1998-01-27 36.06

1998-01-05 36.50

1998-01-02 36.00

[5272 rows x 1 columns]把所有的数据都塞在一起

data = pd.concat([data_PEP,data_KO,data_KDP, data_MNST,],axis=1,)

print(data) PEP KO KDP MNST

1998-01-02 36.00 66.94 NaN 1.810

1998-01-05 36.50 66.44 NaN 1.781

1998-01-06 35.19 66.13 NaN 1.750

1998-01-07 35.88 66.19 NaN 1.719

1998-01-08 35.88 66.63 NaN 1.813

1998-01-09 34.75 64.13 NaN 1.625

1998-01-12 35.38 66.06 NaN 1.500

1998-01-13 36.50 65.38 NaN 1.500

1998-01-14 36.69 64.63 NaN 1.469

1998-01-15 35.94 63.75 NaN 1.625

1998-01-16 36.69 65.00 NaN 1.688

1998-01-20 37.63 65.94 NaN 1.656

1998-01-21 37.00 65.50 NaN 1.750

1998-01-22 36.88 65.44 NaN 1.563

1998-01-23 36.31 63.81 NaN 1.563

1998-01-26 36.44 63.06 NaN 1.719

... ... ... ... ...

2018-10-31 112.38 47.88 26.00 52.850

2018-11-01 111.51 47.74 26.52 54.450

2018-12-11 117.29 49.54 26.29 57.580

2018-12-12 117.00 49.22 26.12 57.440

2018-12-13 118.35 49.47 26.15 53.430

[5272 rows x 4 columns]

/opt/conda/lib/python3.5/site-packages/ipykernel_launcher.py:1: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

"""Entry point for launching an IPython kernel.只为案例:我们这里挑个时间段 2015-05-01 ~ 2016-05-01

data = data['2016-03-01':'2016-10-01']除此之外,我们还要把数据中的Nan给解决好。比如,如果当日的close是Nan,说明要么数据遗漏,要么当日没有开,那么我们沿用前一天的价格

data.fillna(method='ffill')| PEP | KO | KDP | MNST | |

|---|---|---|---|---|

| 2016-03-01 | 99.09 | 43.69 | 92.71 | 129.73 |

| 2016-03-02 | 98.33 | 43.77 | 91.98 | 127.75 |

| 2016-03-03 | 99.16 | 43.96 | 91.95 | 128.47 |

| 2016-03-04 | 100.00 | 44.11 | 91.78 | 128.89 |

| 2016-03-07 | 99.25 | 44.01 | 90.21 | 127.99 |

| 2016-03-08 | 99.74 | 44.32 | 90.75 | 129.33 |

| 2016-03-09 | 100.20 | 44.81 | 92.02 | 130.07 |

| 2016-03-10 | 100.78 | 45.23 | 92.12 | 131.65 |

| 2016-03-11 | 101.31 | 45.20 | 91.04 | 133.86 |

| 2016-03-14 | 100.65 | 45.29 | 90.75 | 131.96 |

| 2016-03-18 | 101.29 | 45.60 | 90.35 | 136.53 |

| 2016-03-21 | 101.54 | 45.67 | 90.24 | 134.52 |

| 2016-03-22 | 100.77 | 45.50 | 89.37 | 134.60 |

| 2016-03-23 | 100.81 | 45.46 | 89.96 | 132.83 |

| 2016-03-24 | 100.68 | 45.58 | 88.23 | 131.25 |

| 2016-09-07 | 107.21 | 43.64 | 93.55 | 152.17 |

| 2016-09-08 | 106.88 | 43.63 | 92.99 | 152.12 |

| 2016-09-09 | 104.05 | 42.27 | 89.84 | 147.55 |

| 2016-09-12 | 106.02 | 43.19 | 91.26 | 148.30 |

150 rows × 4 columns

# n = data.shape

# print(n)

# (150, 4)

# type(data)

# pandas.core.frame.DataFrame

# row_n = 4

# score_matrix = np.zeros((row_n, row_n))

# score_matrix[:2]

# pvalue_matrix = np.ones((row_n, row_n))

# pvalue_matrix

keys = data.keys()

print(keys)

Index(['PEP', 'KO', 'KDP', 'MNST'], dtype='object')寻找Cointegration

我们这一个步骤来做这件事:

对于所有的目标池内的股票,我们计算他们是否各自Coint:

# 两两配对,算一下Coint

def find_cointegrated_pairs(data):

n = data.shape[1]

score_matrix = np.zeros((n, n))

pvalue_matrix = np.ones((n, n))

keys = data.keys()

pairs = []

for i in range(n):

for j in range(i+1, n):

S1 = data[keys[i]]

S2 = data[keys[j]]

result = coint(S1, S2)

score = result[0]

pvalue = result[1]

score_matrix[i, j] = score

pvalue_matrix[i, j] = pvalue

if pvalue < 0.05:

pairs.append((keys[i], keys[j]))

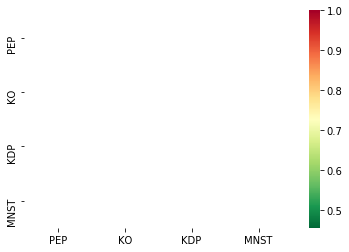

return score_matrix, pvalue_matrix, pairs我们把算出来的数值都画出来,可以直观的看到哪一对最好:

import numpy as np

from statsmodels.tsa.stattools import coint

%matplotlib inline

scores, pvalues, pairs = find_cointegrated_pairs(data)

import seaborn

# 直观点把这个图画出来

seaborn.heatmap(pvalues, xticklabels=['PEP','KO','KDP','MNST'], yticklabels=['PEP','KO','KDP','MNST'], cmap='RdYlGn_r'

, mask = (pvalues >= 0.05)

)/opt/conda/lib/python3.5/site-packages/statsmodels/compat/pandas.py:56: FutureWarning: The pandas.core.datetools module is deprecated and will be removed in a future version. Please use the pandas.tseries module instead.

from pandas.core import datetools

<matplotlib.axes._subplots.AxesSubplot at 0x7f70b5a34470>

由图可见,我们可以挑 ['KDP', 'MNST'] 这一对,作为我们重点考察目标:

S1 = data['KDP']

S2 = data['MNST']我们来看看此刻的P-value是多少

score, pvalue, _ = coint(S1, S2)

pvalue0.4548934445039827计算Spread

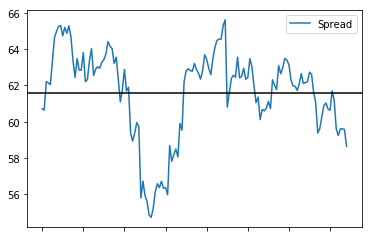

按照之前讲的套路,计算S1和S2的OLS,得到我们的spread,并画出图像

import statsmodels

import statsmodels.api as sm

import matplotlib.pyplot as plt

print("S1\n",S1.head(5))

S1 = sm.add_constant(S1)

print("S1-constant\n", S1.head(5))

# OLS 最小二乘法

results = sm.OLS(S2, S1).fit()

S1 = S1['KDP']

print("results:\n", results.params);

# 打印出一个模型的诊断细节

print("results.summary:\n", results.summary());

b = results.params['KDP']

spread = S2 - b * S1

spread.plot()

plt.axhline(spread.mean(), color='black')

plt.legend(['Spread']);S1

2018-03-01 116.44

2018-03-02 116.24

2018-03-05 115.91

2018-03-06 116.12

2018-03-07 116.30

Name: KDP, dtype: float64

S1-constant

const KDP

2018-03-01 1.0 116.44

2018-03-02 1.0 116.24

2018-03-05 1.0 115.91

2018-03-06 1.0 116.12

2018-03-07 1.0 116.30

results:

const 61.59733

KDP -0.05579

dtype: float64

results.summary:

OLS Regression Results

==============================================================================

Dep. Variable: MNST R-squared: 0.533

Model: OLS Adj. R-squared: 0.530

Method: Least Squares F-statistic: 167.7

Date: Sun, 06 Oct 2019 Prob (F-statistic): 4.51e-26

Time: 08:17:25 Log-Likelihood: -345.15

No. Observations: 149 AIC: 694.3

Df Residuals: 147 BIC: 700.3

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 61.5973 0.406 151.771 0.000 60.795 62.399

KDP -0.0558 0.004 -12.950 0.000 -0.064 -0.047

==============================================================================

Omnibus: 20.992 Durbin-Watson: 0.141

Prob(Omnibus): 0.000 Jarque-Bera (JB): 25.176

Skew: -0.979 Prob(JB): 3.41e-06

Kurtosis: 3.469 Cond. No. 189.

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

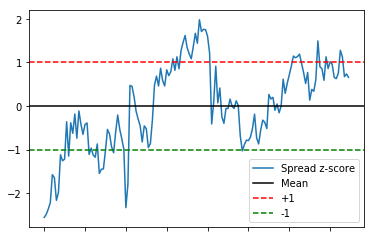

按照标准measurement,算个Standard Score,这样我们可以清楚看到基准线(=0),也可以很轻松的画出两条边际线

def zscore(series):

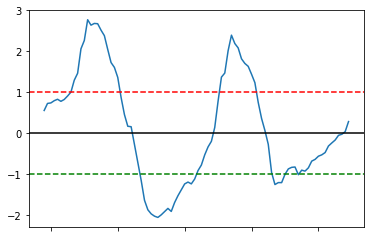

return (series - series.mean()) / np.std(series)此刻,我们就可以按照+1.0和-1.0的,画出两条指导线了

zscore(spread).plot()

plt.axhline(zscore(spread).mean(), color='black')

plt.axhline(1.0, color='red', linestyle='--')

plt.axhline(-1.0, color='green', linestyle='--')

plt.legend(['Spread z-score', 'Mean', '+1', '-1']);

我们的策略行动很简单粗暴:

- 当波动低于-1.0的线,Long the spread

- 当波动高于1.0的线,Short the spread

- 当波动接近于0,退出Hedged Position

【实战】优化版的成对交易模型

Moving Average

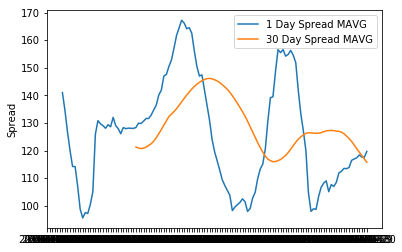

既然是滚动平均值,那我们就需要一个滚动的OLS来计算每一次:

from pyfinance.ols import PandasRollingOLS

rolling_beta = PandasRollingOLS(y=S1, x=S2, window=30)

print(rolling_beta.beta.head()) feature1

2016-04-12 -0.119287

2016-04-13 -0.063562

2016-04-14 0.018802

2016-04-15 0.094118

2016-04-18 0.151175然后,我们用这个滚动的OLS,去计算滚动的平均值:

spread = S2 - rolling_beta.beta['feature1'] * S1

spread.name = 'spread'

# 画出每一天的MAVG

spread_mavg1 = spread.rolling(window=1).mean()

spread_mavg1.name = 'spread 1d mavg'

# 画出每30天的MAVG

spread_mavg30 = spread.rolling(window=30).mean()

spread_mavg30.name = 'spread 30d mavg'

plt.plot(spread_mavg1.index, spread_mavg1.values)

plt.plot(spread_mavg30.index, spread_mavg30.values)

plt.legend(['1 Day Spread MAVG', '30 Day Spread MAVG'])

plt.ylabel('Spread');

大家看到,楼上的滚动平均值更加的平滑,并且我们更准确清晰地知道什么时候我们要采取什么策略。

相比于单独的一个全局平均值,滚动平均值会随着市场的变化而变化,更加符合我们曲线的走势。

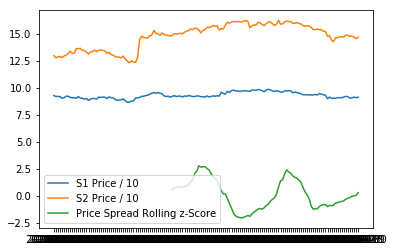

既然我们有了1天和30天的spread,我们就可以把这两个值当作我们的x和y,并用他们计算出一个统一的standard score,

面对这个zscore,我们可以更加直观的看出来我们的股票价格在什么时间点处于“极端值”:

# Take a rolling 30 day standard deviation

std_30 = spread.rolling(window=30).std()

std_30.name = 'std 30d'

# Compute the z score for each day

zscore_30_1 = (spread_mavg1 - spread_mavg30)/std_30

zscore_30_1.name = 'z-score'

zscore_30_1.plot()

plt.axhline(0, color='black')

plt.axhline(1.0, color='red', linestyle='--')

plt.axhline(-1.0, color='green', linestyle='--');

好,为了更加清晰地给大家看看我们这个走势变化与真实股票的关系,

我们可以把三个线 都画在同一个坐标系内:

# Plot the prices scaled down along with the negative z-score

# just divide the stock prices by 10 to make viewing it on the plot easier

plt.plot(S1.index, S1.values/10)

plt.plot(S2.index, S2.values/10)

plt.plot(zscore_30_1.index, zscore_30_1.values)

plt.legend(['S1 Price / 10', 'S2 Price / 10', 'Price Spread Rolling z-Score']);

Out of Sample

如果我们的目标数据在我们考察的时间段范围以外怎么办?这样我们就需要再做一次Coint测试

比如,我们拿出一个S1与S2在新的时间段中的数据比较:

data_KDP = pd.read_csv('./data/daily_KDP.csv', index_col=[0],usecols=['timestamp','close'])

data_KDP.columns = ["KDP"]

data_MNST = pd.read_csv('./data/daily_MNST.csv', index_col=[0],usecols=['timestamp','close'])

data_MNST.columns = ["MNST"]

data = pd.concat([data_KDP, data_MNST,],axis=1,)

data = data['2018-03-01':'2018-10-01']

data.fillna(method='ffill')/opt/conda/lib/python3.5/site-packages/ipykernel_launcher.py:5: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

"""| KDP | MNST | |

|---|---|---|

| 2018-03-01 | 116.44 | 54.22 |

| 2018-03-02 | 116.24 | 54.16 |

| 2018-03-05 | 115.91 | 55.74 |

| 2018-03-06 | 116.12 | 55.67 |

| 2018-03-07 | 116.30 | 55.55 |

| ... | ... | ... |

| 2018-10-01 | 23.10 | 57.36 |

149 rows × 2 columns

S1 = data['KDP']

S2 = data['MNST']score, pvalue, _ = coint(S1, S2)

print(pvalue)0.5241888917528962看,这个值明显大于了我们的threshold 0.05,所以我们就不可以再用他们两对来进行成对交易。

所以这个时候,我们就该退出我们的交易策略,并寻找新的可能性机会。

为者常成,行者常至

自由转载-非商用-非衍生-保持署名(创意共享3.0许可证)