数字货币量化之仓位管理的实现 (上)

交易周期操作更新

handle_data

- handle_data() 函数在每个bar数据交易周期的结束时刻运行

- 可以使用当前交易周期的close数据,之前我们都是用的前三天的数据,现在只需要两天,因为可以拿到当天的收盘价

- 此时交易的价格为 close 数据

基准策略

- 投资组合:BTC,ETH,LTC,EOS

- 复利/不复利方式

- 头寸规模确定:等额资金分配

- 结果:

- 策略收益: 119.238%

- 策略年化收益:70.949%

- 策略波动率:37.756%

- 夏普比率:1.622

- 最大回撤:25.636%

代码实战

dma_baisc_alg.py

"""

双均线基准策略

- 等额资金分配

"""

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

from catalyst import run_algorithm

from catalyst.api import record, symbol, order_target, order

from logbook import Logger

# 需要先加载数据

# catalyst ingest-exchange -x binance -i btc_usdt -f daily

# catalyst ingest-exchange -x binance -i eth_usdt -f daily

# catalyst ingest-exchange -x binance -i ltc_usdt -f daily

# catalyst ingest-exchange -x binance -i eos_usdt -f daily

NAMESPACE = 'dma_basic'

log = Logger(NAMESPACE)

SHORT_WIN = 5 # 短周期窗口

LONG_WIN = 25 # 长周期窗口

def get_available_cash(context, use_compound_interest=False):

"""

获取当前可用资金

use_compound_interest: 是否使用复利

"""

if use_compound_interest:

# 使用复利

available_cash = context.portfolio.cash

else:

available_cash = min(context.portfolio.starting_cash, context.portfolio.cash)

return available_cash

def get_risk_indices(perf):

"""

计算风险指标,包括:

1. 策略收益

2. 策略年化收益

3. 策略波动率

4. 夏普比率

5. 最大回撤

"""

# 策略执行天数

n = len(perf)

# 1. 策略收益

total_returns = perf.iloc[-1]['algorithm_period_return']

# 2. 策略年化收益

total_ann_returns = (1 + total_returns) ** (250 / n) - 1

# 3. 策略波动率(catalyst框架已经帮我们计算出来了)

algo_volatility = perf.iloc[-1]['algo_volatility']

# 4. 夏普比率

sharpe = perf.iloc[-1]['sharpe']

# 5. 最大回撤

max_drawdown = np.abs(perf.iloc[-1]['max_drawdown'])

return total_returns, total_ann_returns, algo_volatility, sharpe, max_drawdown

def initialize(context):

"""

初始化

"""

log.info('策略初始化')

context.i = 0 # 经历过的交易周期

# 设置加密货币池

context.asset_pool = [symbol('btc_usdt'),

symbol('eth_usdt'),

symbol('ltc_usdt'),

symbol('eos_usdt')]

context.set_commission(maker=0.001, taker=0.001) # 设置手续费

context.set_slippage(slippage=0.001) # 设置滑点

def handle_data(context, data):

"""

在每个交易周期上运行的策略

"""

context.i += 1 # 记录交易周期,因为可以拿到当天的收盘价,所以,这里加1,而不是之前的加2了

if context.i < LONG_WIN + 1:

# 如果交易周期过短,无法计算均线,则跳过循环

log.warning('交易周期过短,无法计算指标')

return

# 获取当前周期内有效的加密货币

context.available_asset_pool = [asset

for asset in context.asset_pool

if asset.start_date <= data.current_dt]

context.up_cross_signaled = set() # 初始化金叉的交易对集合

context.down_cross_signaled = set() # 初始化死叉的交易对集合

for asset in context.available_asset_pool:

# 遍历每一个加密货币对

# 获得历史价格

hitory_data = data.history(asset,

'close',

bar_count=LONG_WIN + 1,

frequency='1D',

)

if len(hitory_data) >= LONG_WIN + 1:

# 保证新的货币有足够的时间计算均线

# 计算双均线

short_avgs = hitory_data.rolling(window=SHORT_WIN).mean()

long_avgs = hitory_data.rolling(window=LONG_WIN).mean()

# 双均线策略

# 短期均线上穿长期均线,短期前一天小于长期,并且 当天短期大于长期,则为金叉

if (short_avgs[-2] < long_avgs[-2]) and (short_avgs[-1] >= long_avgs[-1]):

# 形成金叉

context.up_cross_signaled.add(asset)

# 短期均线下穿长期均线

if (short_avgs[-2] > long_avgs[-2]) and (short_avgs[-1] <= long_avgs[-1]):

# 形成死叉

context.down_cross_signaled.add(asset)

# 卖出均线死叉信号的持仓交易对

for asset in context.portfolio.positions:

if asset in context.down_cross_signaled:

order_target(asset, 0)

# 买入均线金叉信号的持仓股

for asset in context.up_cross_signaled:

if asset not in context.portfolio.positions:

close_price = data.current(asset, 'close')

available_cash = get_available_cash(context)

if available_cash > 0:

# 如果有可用现金

# 每个交易对平均分配现金

cash_for_each_asset = available_cash / len(context.available_asset_pool)

amount_to_buy = cash_for_each_asset / close_price # 计算购买的数量

if amount_to_buy >= asset.min_trade_size:

# 购买的数量大于最小购买数量

order(asset, amount_to_buy)

# 持仓比例

pos_level = context.portfolio.positions_value / context.portfolio.portfolio_value

# 记录每个交易周期的现金

record(cash=context.portfolio.cash, pos_level=pos_level)

# 输出信息

log.info('日期:{},资产:{:.2f},持仓比例:{:.6f}%,持仓产品:{}'.format(

data.current_dt, context.portfolio.portfolio_value, pos_level * 100,

', '.join([asset.asset_name for asset in context.portfolio.positions]))

)

def analyze(context, perf):

# 保存交易记录

perf.to_csv('./perf_results/dma_basic_performance.csv')

# 获取交易所的计价货币

exchange = list(context.exchanges.values())[0]

quote_currency = exchange.quote_currency.upper()

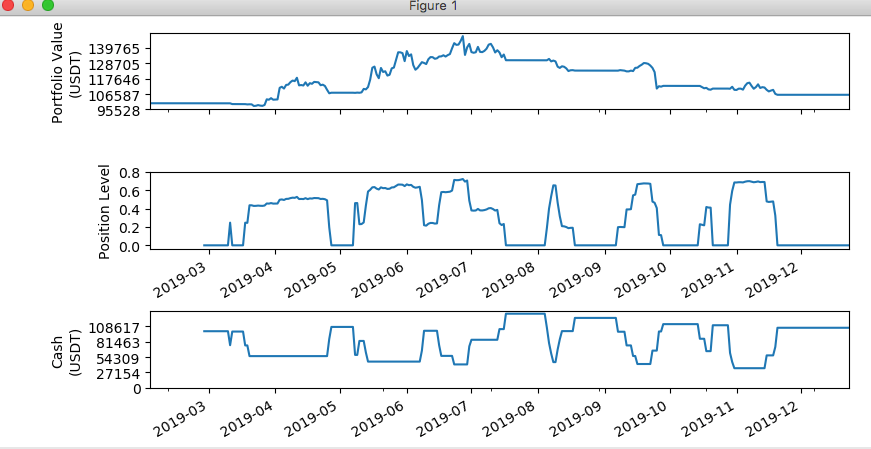

# 图1:可视化资产值

ax1 = plt.subplot(311)

perf['portfolio_value'].plot(ax=ax1)

ax1.set_ylabel('Portfolio Value\n({})'.format(quote_currency))

start, end = ax1.get_ylim()

ax1.yaxis.set_ticks(np.arange(start, end, (end - start) / 5))

# 图2:可视化仓位

ax2 = plt.subplot(312)

perf['pos_level'].plot(ax=ax2)

ax2.set_ylabel('Position Level')

start, end = 0, 1

ax2.yaxis.set_ticks(np.arange(start, end, (end - start) / 5))

# 图3:可视化现金数量

ax3 = plt.subplot(313, sharex=ax1)

perf['cash'].plot(ax=ax3)

ax3.set_ylabel('Cash\n({})'.format(quote_currency))

start, end = ax3.get_ylim()

ax3.yaxis.set_ticks(np.arange(0, end, end / 5))

plt.tight_layout()

plt.show()

# 评价策略

total_returns, total_ann_returns, algo_volatility, sharpe, max_drawdown = get_risk_indices(perf)

log.info('策略收益: {:.3f}%, 策略年化收益: {:.3f}%, 策略波动率: {:.3f}%, 夏普比率: {:.3f}, 最大回撤: {:.3f}%'.format(

total_returns * 100, total_ann_returns * 100, algo_volatility * 100, sharpe, max_drawdown * 100

))

if __name__ == '__main__':

run_algorithm(

capital_base=100000,

data_frequency='daily',

initialize=initialize,

handle_data=handle_data,

analyze=analyze,

exchange_name='binance',

algo_namespace=NAMESPACE,

quote_currency='usdt',

start=pd.to_datetime('2019-02-01', utc=True),

end=pd.to_datetime('2019-12-22', utc=True)

)

结果打印:

[2019-12-23 15:13:58.068289] INFO: dma_basic: 日期:2019-05-11 23:59:00+00:00,资产:110325.41,持仓比例:24.913164%,持仓产品:ETH / USDT

[2019-12-23 15:13:58.085725] INFO: dma_basic: 日期:2019-05-12 23:59:00+00:00,资产:109982.83,持仓比例:43.141850%,持仓产品:ETH / USDT, LTC / USDT

[2019-12-23 15:13:58.108327] INFO: dma_basic: 日期:2019-05-13 23:59:00+00:00,资产:111648.70,持仓比例:58.511697%,持仓产品:ETH / USDT, LTC / USDT, EOS / USDT

[2019-12-23 15:13:58.128956] INFO: dma_basic: 日期:2019-05-14 23:59:00+00:00,资产:116988.33,持仓比例:60.405324%,持仓产品:ETH / USDT, LTC / USDT, EOS / USDT

[2019-12-23 15:13:58.150533] INFO: dma_basic: 日期:2019-05-15 23:59:00+00:00,资产:125528.28,持仓比例:63.099033%,持仓产品:ETH / USDT, LTC / USDT, EOS / USDT

.

.

.

[2019-12-23 15:13:58.933136] INFO: dma_basic: 日期:2019-06-22 23:59:00+00:00,资产:143255.38,持仓比例:71.138528%,持仓产品:LTC / USDT, BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:58.955364] INFO: dma_basic: 日期:2019-06-23 23:59:00+00:00,资产:141999.41,持仓比例:70.883250%,持仓产品:LTC / USDT, BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:58.976089] INFO: dma_basic: 日期:2019-06-24 23:59:00+00:00,资产:142209.20,持仓比例:70.926205%,持仓产品:LTC / USDT, BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:58.998289] INFO: dma_basic: 日期:2019-06-25 23:59:00+00:00,资产:144850.17,持仓比例:71.456289%,持仓产品:LTC / USDT, BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:59.021467] INFO: dma_basic: 日期:2019-06-26 23:59:00+00:00,资产:148310.38,持仓比例:72.122239%,持仓产品:LTC / USDT, BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:59.043160] INFO: dma_basic: 日期:2019-06-27 23:59:00+00:00,资产:134755.19,持仓比例:69.317981%,持仓产品:LTC / USDT, BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:59.066632] INFO: dma_basic: 日期:2019-06-28 23:59:00+00:00,资产:140203.28,持仓比例:70.510239%,持仓产品:LTC / USDT, BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:59.089773] INFO: dma_basic: 日期:2019-06-29 23:59:00+00:00,资产:142700.00,持仓比例:48.635408%,持仓产品:BTC / USDT, ETH / USDT, EOS / USDT

[2019-12-23 15:13:59.110369] INFO: dma_basic: 日期:2019-06-30 23:59:00+00:00,资产:136816.77,持仓比例:37.958767%,持仓产品:BTC / USDT, ETH / USDT

[2019-12-23 15:13:59.135115] INFO: dma_basic: 日期:2019-07-01 23:59:00+00:00,资产:136320.93,持仓比例:37.733107%,持仓产品:BTC / USDT, ETH / USDT

...

[2019-12-23 15:14:01.913691] INFO: dma_basic: 日期:2019-11-15 23:59:00+00:00,资产:108507.63,持仓比例:47.196208%,持仓产品:EOS / USDT, LTC / USDT, ETH / USDT

[2019-12-23 15:14:01.932070] INFO: dma_basic: 日期:2019-11-16 23:59:00+00:00,资产:109138.60,持仓比例:47.501485%,持仓产品:EOS / USDT, LTC / USDT, ETH / USDT

[2019-12-23 15:14:01.952659] INFO: dma_basic: 日期:2019-11-17 23:59:00+00:00,资产:109637.98,持仓比例:47.740609%,持仓产品:EOS / USDT, LTC / USDT, ETH / USDT

[2019-12-23 15:14:01.979233] INFO: dma_basic: 日期:2019-11-18 23:59:00+00:00,资产:106747.06,持仓比例:32.388759%,持仓产品:EOS / USDT, ETH / USDT

[2019-12-23 15:14:02.003355] INFO: dma_basic: 日期:2019-11-19 23:59:00+00:00,资产:106085.48,持仓比例:0.000000%,持仓产品:风险指标:

[2019-12-23 15:14:02.614208] INFO: Performance: last close: 2019-12-22 23:59:00+00:00

[2019-12-23 15:38:27.865038] INFO: dma_basic: 策略收益: 6.085%, 策略年化收益: 4.649%, 策略波动率: 25.757%, 夏普比率: 0.307, 最大回撤: 28.471%为者常成,行者常至

自由转载-非商用-非衍生-保持署名(创意共享3.0许可证)