数字货币量化之止盈和止损

完善双均线策略

浮动止盈

- 算法描述

- 建仓后,时刻记录产品价格的最高点

- 计算最新价相对于前期最高点下跌幅幅度的百分比

- 如果下跌百分比大于某个阀值,止盈退出

- 结果:

- 策略收益 194.24%

- 策略年化收益:109.006%

- 策略波动率:54.675%

- 夏普比率:1.604

- 最大回撤: 37.042%

代码实战

dma_float_exit_alg.py (浮动止盈)

"""

双均线改进策略

- 浮动止盈

"""

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import talib

from logbook import Logger

from catalyst import run_algorithm

from catalyst.api import record, symbol, order_target, order

# 需要先加载数据

# catalyst ingest-exchange -x binance -i btc_usdt -f daily

# catalyst ingest-exchange -x binance -i eth_usdt -f daily

# catalyst ingest-exchange -x binance -i ltc_usdt -f daily

# catalyst ingest-exchange -x binance -i eos_usdt -f daily

NAMESPACE = 'dma_float_exit_alg'

log = Logger(NAMESPACE)

SHORT_WIN = 5 # 短周期窗口

LONG_WIN = 20 # 长周期窗口

ATR_WIN_SIZE = 20 # ATR窗口

RISK_RATIO = 0.05 # 风险比例

INC_POS_RATE = 0.05 # 价格每上涨5%加仓

MAX_DROP_RATE = 0.3 # 从最高点回撤的百分比

def get_available_cash(context, use_compound_interest=False):

"""

获取当前可用资金

use_compound_interest: 是否使用复利

"""

if use_compound_interest:

# 使用复利

available_cash = context.portfolio.cash

else:

available_cash = min(context.portfolio.starting_cash, context.portfolio.cash)

return available_cash

def get_risk_indices(perf):

"""

计算风险指标,包括:

1. 策略收益

2. 策略年化收益

3. 策略波动率

4. 夏普比率

5. 最大回撤

"""

# 策略执行天数

n = len(perf)

# 1. 策略收益

total_returns = perf.iloc[-1]['algorithm_period_return']

# 2. 策略年化收益

total_ann_returns = (1 + total_returns) ** (250 / n) - 1

# 3. 策略波动率

algo_volatility = perf.iloc[-1]['algo_volatility']

# 4. 夏普比率

sharpe = perf.iloc[-1]['sharpe']

# 5. 最大回撤

max_drawdown = np.abs(perf.iloc[-1]['max_drawdown'])

return total_returns, total_ann_returns, algo_volatility, sharpe, max_drawdown

def initialize(context):

"""

初始化

"""

context.i = 0 # 经历过的交易周期

# 设置加密货币池

context.asset_pool = [symbol('btc_usdt'),

symbol('eth_usdt'),

symbol('ltc_usdt'),

symbol('eos_usdt')]

context.set_commission(maker=0.001, taker=0.001) # 设置手续费

context.set_slippage(slippage=0.001) # 设置滑点

# 初始化字典,用于记录上一次买入加密货币的价格

context.last_price = {asset: None for asset in context.asset_pool}

# 初始化字典,用于记录在当前交易周期中加密货币是否被交易过

# 这里限制每天只能交易一次

context.traded_today = {asset: False for asset in context.asset_pool}

# 初始化字典,用于记录上一次买入加密货币的日期

context.entry_dates = {asset: None for asset in context.asset_pool}

def handle_data(context, data):

"""

在每个交易周期上运行的策略

"""

context.i += 1 # 记录交易周期

for asset in context.traded_today:

# 每个交易周期重置交易flag

context.traded_today[asset] = False

if context.i < LONG_WIN + 1:

# 如果交易周期过短,无法计算均线,则跳过循环

log.warning('交易周期过短,无法计算指标')

return

# 获取当前周期内有效的加密货币

context.available_asset_pool = [asset

for asset in context.asset_pool

if asset.start_date <= data.current_dt]

context.up_cross_signaled = set() # 初始化金叉的交易对集合

context.down_cross_signaled = set() # 初始化死叉的交易对集合

for asset in context.available_asset_pool:

# 遍历每一个加密货币对

# 获得历史价格

hitory_data = data.history(asset,

'close',

bar_count=LONG_WIN + 1,

frequency='1D',

)

if len(hitory_data) >= LONG_WIN + 1:

# 保证新的货币有足够的时间计算均线

# 计算双均线

short_avgs = hitory_data.rolling(window=SHORT_WIN).mean()

long_avgs = hitory_data.rolling(window=LONG_WIN).mean()

# 双均线策略

# 短期均线上穿长期均线

if (short_avgs[-2] < long_avgs[-2]) and (short_avgs[-1] >= long_avgs[-1]):

# 形成金叉

context.up_cross_signaled.add(asset)

# 短期均线下穿长期均线

if (short_avgs[-2] > long_avgs[-2]) and (short_avgs[-1] <= long_avgs[-1]):

# 形成死叉

context.down_cross_signaled.add(asset)

# 卖出均线死叉信号的持仓交易对

for asset in context.portfolio.positions:

if context.traded_today[asset]:

# 当前交易周期中该产品被交易过,跳过循环

continue

if asset in context.down_cross_signaled:

order_target(asset, 0)

# 卖出货币对,重置购买价和买入日期

context.last_price[asset] = None

context.entry_dates[asset] = None

context.traded_today[asset] = True

# 检查有无符合浮动止盈的持仓品种

for asset in context.portfolio.positions:

if context.traded_today[asset]:

# 当前交易周期中该产品被交易过,跳过循环

continue

if context.portfolio.positions[asset].amount > 0:

last_entry_date = context.entry_dates[asset] # 上一次买入的日期

bar_count = (data.current_dt - last_entry_date).days + 1

# 计算截止到当前交易周期的最高价最大值(Highest High Value, HHV)

history_data = data.history(asset,

['high', 'close'],

bar_count=bar_count,

frequency='1D',

)

if len(history_data) > 1:

hhv = history_data['high'].max()

drop_rate = (hhv - history_data.iloc[-1]['close']) / hhv # 以当前交易周期的收盘价计算跌幅比例

if drop_rate > MAX_DROP_RATE:

log.info('止盈操作...')

order_target(asset, 0)

context.last_price[asset] = None

context.entry_dates[asset] = None

context.traded_today[asset] = True

# 买入均线金叉信号的持仓股

for asset in context.up_cross_signaled:

if context.traded_today[asset]:

# 当前交易周期中该产品被交易过,跳过循环

continue

if asset not in context.portfolio.positions:

history_data = data.history(asset,

['high', 'low', 'close'],

bar_count=ATR_WIN_SIZE + 1,

frequency='1D',

)

atr = talib.ATR(history_data['high'], history_data['low'], history_data['close'],

timeperiod=ATR_WIN_SIZE)

available_cash = get_available_cash(context)

if available_cash > 0:

# 如果有可用现金

amount_to_buy = available_cash * RISK_RATIO / atr[-1] # 计算购买的数量

close_price = data.current(asset, 'close')

if (amount_to_buy >= asset.min_trade_size) and (available_cash >= amount_to_buy * close_price):

# 购买的数量大于最小购买数量并且有足够的现金购买

order(asset, amount_to_buy)

# 买入货币对,记录购买日期和购买价

context.entry_dates[asset] = data.current_dt

context.last_price[asset] = close_price

context.traded_today[asset] = True

# 检查有无符合加仓条件的持仓品种

for asset in context.portfolio.positions:

if context.traded_today[asset]:

# 当前交易周期中该产品被交易过,跳过循环

continue

if context.portfolio.positions[asset].amount > 0:

close_price = data.current(asset, 'close')

last_price = context.last_price[asset]

if (close_price - last_price) / last_price >= INC_POS_RATE:

available_cash = get_available_cash(context)

if available_cash > 0:

# 如果有可用现金

# 按盈利比例均匀加仓

log.info('加仓操作...')

cash_for_each_asset = available_cash / len(context.available_asset_pool)

amount_to_buy = cash_for_each_asset / close_price

if amount_to_buy >= asset.min_trade_size:

# 购买的数量大于最小购买数量

order(asset, amount_to_buy)

# 买入货币对,记录购买日期和购买价

context.entry_dates[asset] = data.current_dt

context.last_price[asset] = close_price

context.traded_today[asset] = True

# 持仓比例

pos_level = context.portfolio.positions_value / context.portfolio.portfolio_value

# 记录每个交易周期的现金

record(cash=context.portfolio.cash, pos_level=pos_level)

# 输出信息

log.info('日期:{},资产:{:.2f},持仓比例:{:.6f}%,持仓产品:{}'.format(

data.current_dt, context.portfolio.portfolio_value, pos_level * 100,

', '.join([asset.asset_name for asset in context.portfolio.positions]))

)

def analyze(context, perf):

# 保存交易记录

perf.to_csv('./perf_results/dma_float_exit_performance.csv')

# 获取交易所的计价货币

exchange = list(context.exchanges.values())[0]

quote_currency = exchange.quote_currency.upper()

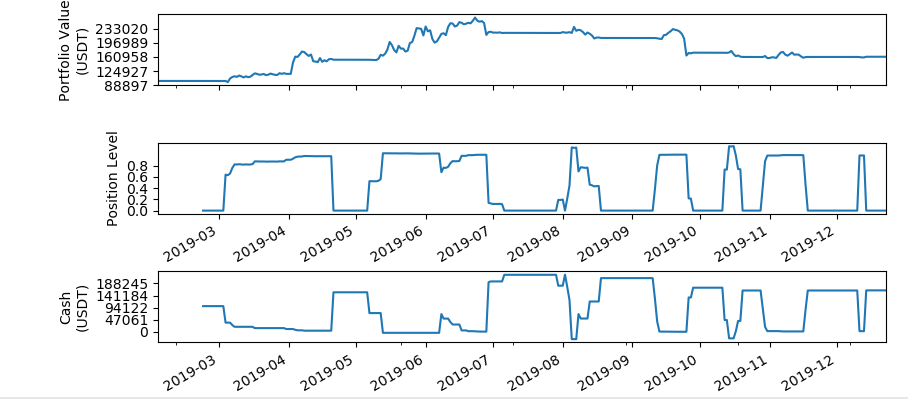

# 图1:可视化资产值

ax1 = plt.subplot(311)

perf['portfolio_value'].plot(ax=ax1)

ax1.set_ylabel('Portfolio Value\n({})'.format(quote_currency))

start, end = ax1.get_ylim()

ax1.yaxis.set_ticks(np.arange(start, end, (end - start) / 5))

# 图2:可视化仓位

ax2 = plt.subplot(312)

perf['pos_level'].plot(ax=ax2)

ax2.set_ylabel('Position Level')

start, end = 0, 1

ax2.yaxis.set_ticks(np.arange(start, end, (end - start) / 5))

# 图3:可视化现金数量

ax3 = plt.subplot(313, sharex=ax1)

perf['cash'].plot(ax=ax3)

ax3.set_ylabel('Cash\n({})'.format(quote_currency))

start, end = ax3.get_ylim()

ax3.yaxis.set_ticks(np.arange(0, end, end / 5))

plt.tight_layout()

plt.show()

# 评价策略

total_returns, total_ann_returns, algo_volatility, sharpe, max_drawdown = get_risk_indices(perf)

log.info('策略收益: {:.3f}%, 策略年化收益: {:.3f}%, 策略波动率: {:.3f}%, 夏普比率: {:.3f}, 最大回撤: {:.3f}%'.format(

total_returns * 100, total_ann_returns * 100, algo_volatility * 100, sharpe, max_drawdown * 100

))

if __name__ == '__main__':

run_algorithm(

capital_base=100000,

data_frequency='daily',

initialize=initialize,

handle_data=handle_data,

analyze=analyze,

exchange_name='binance',

algo_namespace=NAMESPACE,

quote_currency='usdt',

start=pd.to_datetime('2019-02-01', utc=True),

end=pd.to_datetime('2019-12-22', utc=True)

)

输出打印:

[2019-12-24 15:41:35.332583] INFO: dma_float_exit_alg: 日期:2019-03-02 23:59:00+00:00,资产:100000.00,持仓比例:0.000000%,持仓产品:

[2019-12-24 15:41:35.372880] INFO: dma_float_exit_alg: 日期:2019-03-03 23:59:00+00:00,资产:99871.71,持仓比例:64.194880%,持仓产品:LTC / USDT

[2019-12-24 15:41:35.410091] INFO: dma_float_exit_alg: 日期:2019-03-04 23:59:00+00:00,资产:97085.37,持仓比例:63.167278%,持仓产品:LTC / USDT

[2019-12-24 15:41:35.445014] INFO: dma_float_exit_alg: 加仓操作...

[2019-12-24 15:41:35.445281] INFO: dma_float_exit_alg: 日期:2019-03-05 23:59:00+00:00,资产:106114.18,持仓比例:66.301217%,持仓产品:LTC / USDT

[2019-12-24 15:41:35.480165] INFO: dma_float_exit_alg: 加仓操作...

...

[2019-12-24 15:41:51.127684] INFO: dma_float_exit_alg: 日期:2019-12-09 23:59:00+00:00,资产:160908.44,持仓比例:0.000000%,持仓产品:

[2019-12-24 15:41:51.256723] INFO: dma_float_exit_alg: 日期:2019-12-10 23:59:00+00:00,资产:160592.28,持仓比例:98.386190%,持仓产品:BTC / USDT, EOS / USDT

[2019-12-24 15:41:51.334755] INFO: dma_float_exit_alg: 日期:2019-12-11 23:59:00+00:00,资产:159748.71,持仓比例:98.377668%,持仓产品:BTC / USDT, EOS / USDT

[2019-12-24 15:41:51.378688] INFO: dma_float_exit_alg: 日期:2019-12-12 23:59:00+00:00,资产:159770.24,持仓比例:98.377887%,持仓产品:BTC / USDT, EOS / USDT

[2019-12-24 15:41:51.418849] INFO: dma_float_exit_alg: 日期:2019-12-13 23:59:00+00:00,资产:161364.86,持仓比例:0.000000%,持仓产品:

[2019-12-24 15:41:51.453142] INFO: dma_float_exit_alg: 日期:2019-12-14 23:59:00+00:00,资产:161364.86,持仓比例:0.000000%,持仓产品:

[2019-12-24 15:41:51.486555] INFO: dma_float_exit_alg: 日期:2019-12-15 23:59:00+00:00,资产:161364.86,持仓比例:0.000000%,持仓产品:

[2019-12-24 15:41:51.524502] INFO: dma_float_exit_alg: 日期:2019-12-16 23:59:00+00:00,资产:161364.86,持仓比例:0.000000%,持仓产品:

风险指标:

[2019-12-24 15:44:30.216254] INFO: dma_float_exit_alg: 策略收益: 61.365%, 策略年化收益: 44.495%, 策略波动率: 50.878%, 夏普比率: 0.981, 最大回撤: 39.403%

我们可以看到,这个策略收益是非常可观的,最大回撤也减少了很多。

为者常成,行者常至

自由转载-非商用-非衍生-保持署名(创意共享3.0许可证)