AI For Trading: Distributions of Returns and Prices (9)

Distributions of Returns and Prices

Investors are always interested in the potential appreciation or depreciation of financial assets. They'd like to be able to predict what will happen to assets in the future, hence, they'd like to be able to build models of stock prices and returns. An important first step is to think of these prices and returns as random variables, i.e. outcomes of random phenomena, that take on values as described by distributions. Distributions allow us to summarize the behavior of random variables. So, what are the distributions of returns and prices?

投资者总是对金融资产的潜在升值或贬值感兴趣。他们希望能够预测未来资产会发生什么,因此,他们希望能够建立股票价格和收益模型。重要的第一步是将这些价格和收益视为随机变量,即随机现象的结果,其取决于分布所描述的值。那么,回报和价格的分布是什么?

One strategy for getting a sense of potential future behavior is to look to the past. Let's look at some data from the stock of a familiar company with a storied past, Apple Inc.

了解潜在未来行为的一个策略是回顾过去。让我们看一下熟悉的公司股票的一些数据,这些公司的历史悠久,Apple Inc.

Returns and the Historical Record

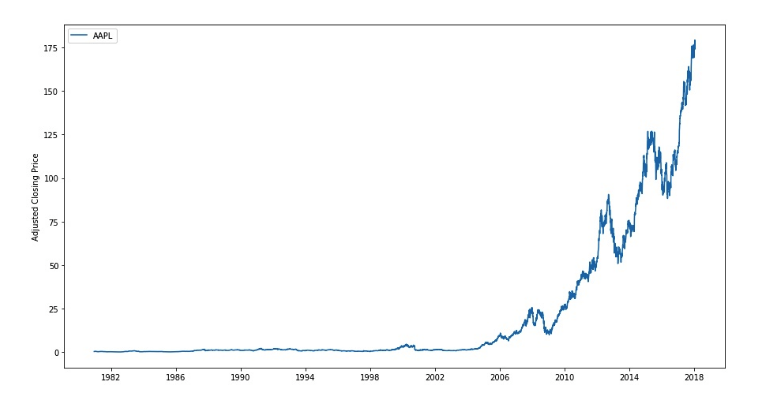

Let's look at the adjusted closing price of Apple stock (AAPL) from 1980 up until the present.

让我们来看看从1980年到现在的Apple股票(AAPL)调整后的收盘价。

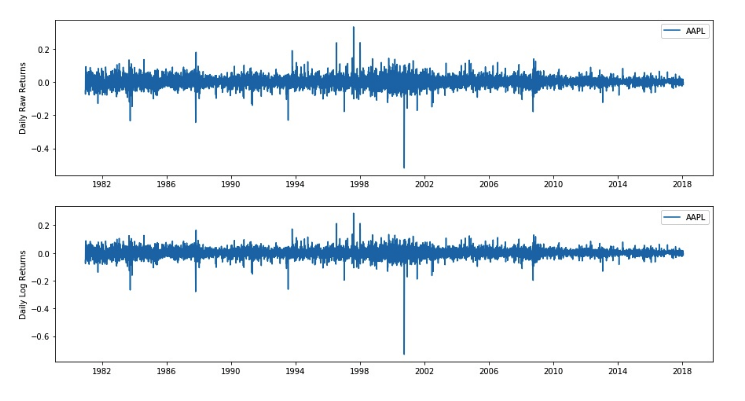

If we calculate returns and log returns on these data and plot them, we'll see something like the graphs below.

The returns and log returns for these daily data have very similar values. This is because daily returns are small—the values are close to 0, so the property \ln(1 + r) \approx rln(1+r)≈r applies. But we're interested in the distribution of these values, so let's look at a histogram.

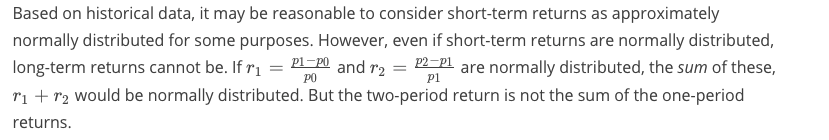

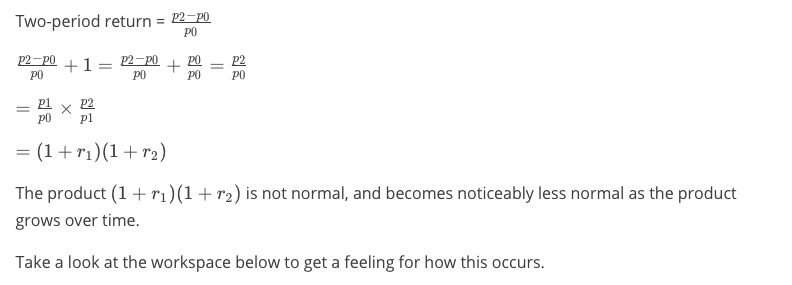

Normality and Long-Term Investments

根据历史数据,将短期收益视为近似正常分配用于某些目的可能是合理的。但是,即使短期回报是正常分配的,长期回报也不可能。

Distribution of Log Returns

因此,长期价格和累积回报可以建模为近似对数正态分布,因为它们是独立的,相同分布(IID)随机变量的产物。另一方面,log随时间返回总和。即使它们不正常,只要它们是IID,由于中心极限定理,它们的长期总和将近似正常。这是使用日志返回可以方便建模的一个原因。

为者常成,行者常至

自由转载-非商用-非衍生-保持署名(创意共享3.0许可证)